At iPipeline, we’ve conducted the most expansive artificial intelligence and machine learning project known to the industry. Our mission was to analyze over 3 million life insurance applications submitted over the last 2 years and across 62 life insurance companies. The purpose? Enable machines to learn recognizable patterns that cause underwriting delays, missing requirements, agent behavior, case manager interactions, and any internal/external factors that could affect placement ratio.

Our goal was to increase the SPEED of underwriting by removing the obstacles that affect policy approval times.

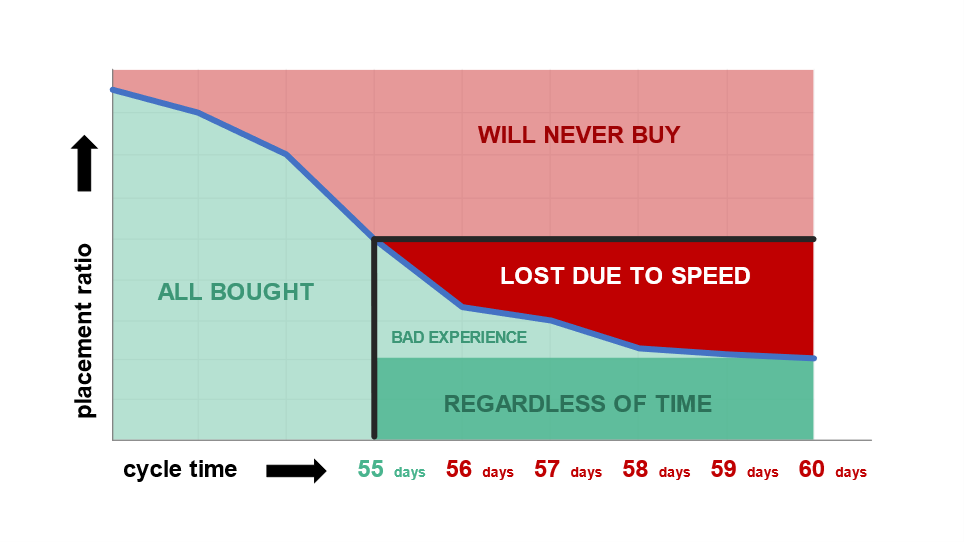

Carriers measure underwriting speed in “cycle times”, and their success by “placement ratio”. Carriers typically define cycle time as the overall elapsed time from the date the carrier receives a submitted application until the date an underwriting decision is made. Cycle times are tricky because days are often not concurrent- instead, they’re a series of start, stop, and wait times. In traditional underwriting, it’s not uncommon for underwriters to wait on paramedical exams, APS’s, and agent responses- many factors that are beyond their control. We found machine learning was necessary to gather, organize and analyze these factors. These relationships were then plotted onto a placement ratio graph for all participating carriers. The graph revealed where the industry’s ratios plateaued, rose, and fell. We then took the same approach to graphing cycle times on each submitted application. Again, we saw various fluctuations. But here’s where the magic occurred: when we overlapped these two graphics, we found a precise day where industry placement ratio significantly dropped.

Across 62 carriers and millions of cases, the most impactful day was day 55.

However, the real “aha” moment was that cases still in underwriting between days 55 and 60 have a 13% decrease in placement ratio. This 5-day window after the day 55 “hour of sour” has huge financial consequences to carriers, so we needed to take a deeper dive. We had the machines segment applicants to filter those that fell below the blue line and purchased a policy. These green folks were then further delineated into policyholders that bought regardless of time, and those that also bought but had a bad experience due to time lags.

Above the blue line, you can see in red all the applicants that didn’t buy. Within this group of red folks, there’s a group that “will never buy”. This may be a result of them changing their mind, maybe losing their job, possibly received a worse underwriting offer, or simply went with another carrier. So the real focus should be on the applicants that did not buy due to lack of SPEED.

If the average carrier could shave 5 days off its’ cycle time, they could shift a block of applicants back into the green side, resulting in millions of additional premium dollars.

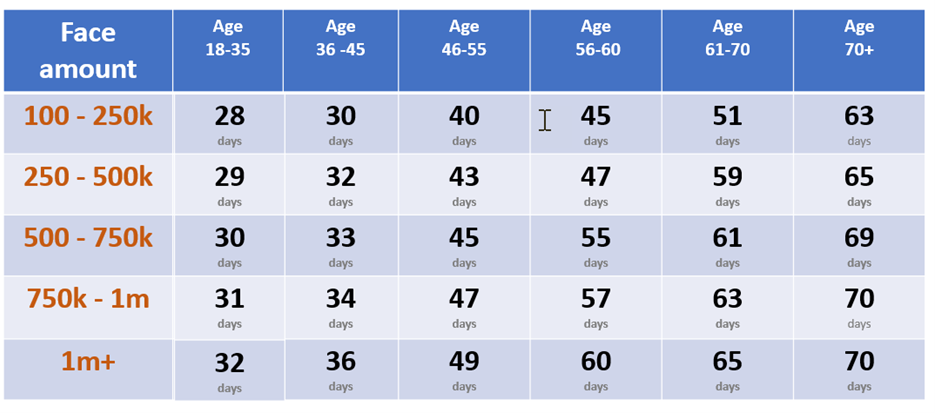

Remember, day 55 is the average across all our participating carriers and all applicant’s ages and face amounts together. The reality is, you can expect younger applicants, with lower face amounts, to fly through underwriting faster than older applicants, with higher face amounts. This is where machine learning really excels and helps uncover the “hour of sour” where placement ratio starts to drop each day.

Cycle Time Measured: Submission to In-Force

Machines can even go deeper by learning the effects that speed has on placement based on gender and product types. Clearly, speed matters. So, ask yourself, “where are you leaking time”? What are the long poles in your “outstanding requirements” tent that are not necessary, chewing up time, or can be fixed with modern technology?

Let’s have a look at some of the top underwriting delays across 62 life carriers:

| Outstanding Requirement | Average Carrier’s Collection Time | Responsible Party |

| APS’s orders | 19.8 days | Carrier |

| Signed illustration | 18.7 days | Agent |

| Paramedical exam | 15.2 days | Agent/Insured |

| Signed Supplemental forms | 14.4 days | Agent |

| Missing application data | 10.3 days | Agent |

| APS review | 1.4 days | Carrier |

| Data entry | 1.3 days | Carrier |

Without a doubt, agent behavior has an impact on underwriting speed. Carriers should be looking at both internal and external factors that contribute to a loss of speed. But this exercise will have little value if the carrier has no industry benchmark with which to compare themselves on speed.

iPipeline’s Resonant does exactly that and more. Resonant tracks millions of underwriting decisions across carriers and uses predictive analytics to optimize underwriting throughput. Once Resonant understands the desired underwriting path, it focuses on the toolsets necessary to execute those specified outcomes.

Resonant is built to shorten your underwriting long poles from submission to decision by providing four key modules to help you shorten your cycle time and increase placement ratio.

1) Workbench – where case managers and underwriters track and manage their individual cases with all the information needed to make a decision at their fingertips.

2) Decision Engine – this houses not only the complexity of underwriting, but also automates the entire new business process including robotic workflow routing of next steps to the right person at the right time.

3) Guideline Manager – provides you with the ability to build and modify the rules that drive the Decision Engine – not only Underwriting guidelines, but also Product, Workflow, NIGO and Suitability.

4) Correspondence – faster messaging to agents and clients.

5) OR Real-Time Dashboards – manage the pending inventory in real-time and quickly take action on cases approaching the “hour of sour”.

The Workbench and Decision Engine/Guideline Manager modules can be used separately or purchased as a suite. Either strategy will enable Resonant to help you to transform underwriting and modernize your technology.

When you’re ready, Resonant will integrate with your e-Application and offer your agents “instant decisioning” on your products that make the most sense. Standard integrations with third party evidence provider tools enable access to critical data in real time. Resonant can provide you with one process to handle the entire spectrum of underwriting from instant to accelerated to traditional.